iNSPRE IS AN INDEPENDENT INVESTMENT

ADVISORY BUSINESS WITH GLOBAL ACCESS

iNTEGRATED

STRATEGIC

PRIVATE

EQUITY & INVESTMENTS

We offer capital raising, investment advisory and transaction support services to global clients.

The market is increasingly dominated by existing, large “global players” that require significant commitment to secure services.

We offer entrepreneurial advice to organisations seeking to grow their capital and or strategy by offering innovative solutions.

We also arrange 3rd party sales and distribution services to existing fund managers by utilising our significant network and expertise.

FUNDING, STRUCTURING & TRANSACTION SOLUTIONS

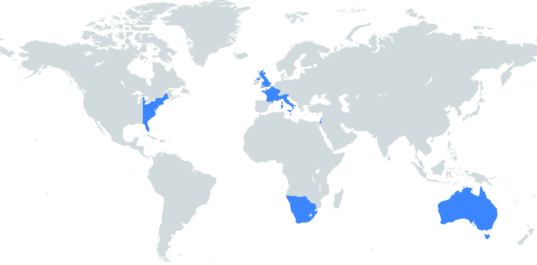

GLOBAL AFFILIATIONS & RELATIONSHIPS

US

East Coast

Europe

UK

France

Italy

Malta

Israel

Africa

South Africa

Namibia

Botswana

Australia

SECTOR FOCUS

iNSPRE has been involved in sourcing and funding alternative energy transactions since inception. We have successfully completed structuring and capital raising projects for a number of significant operational businesses in the UK and Europe.

iNSPRE has been active in the fintech and insuretech space for a number of years utilising our financial services background we have successfully invested in and raised capital for a number of financial services businesses where technology is paramount.

iNSPRE has core competence in financial services and corporate advisory activities. We undertake investment banking, capital raising and structuring mandates tailored to client requirements.

iNSPRE was involved in significant capital raising for one of the worlds oldest airlines and maintains exrptise and relationships in the aviation sector.

CONTACT

iNSPRE Investments is headquartered in London.

4 Hill Street, London W1J 5NE

+44 7985 580 311